Additionally, accounting entries for credit sales can be helpful in spotting trends in customer behaviour. For example, if a business sees a sharp increase in the number of sales credit journal entries, it may be an indication that more customers are buying on credit. By understanding why sales credit journal entries are important, businesses can better manage their finances and make informed decisions about their operations.

How to show Credit Sales in Financial Statements?

Because of this, we have added a 10% tax to the value, which ABC Inc. will collect from XYZ Inc. and pay to the government. Additionally, ABC Inc. is allowed to take an input credit of the same amount and request a refund from the government. Sales made on credit increase the buyer’s inventory while also giving them adequate time to sell the item and pay their supplier. This credit period is often chosen well in advance and may differ by industry. Penalties or legal action against the defaulter may also result from failure to pay on time. This is a fundamental aspect of bookkeeping and accounting, and understanding the debits and credits involved is vital as an accountant.

How to Show Credit Sales in Financial Statements?

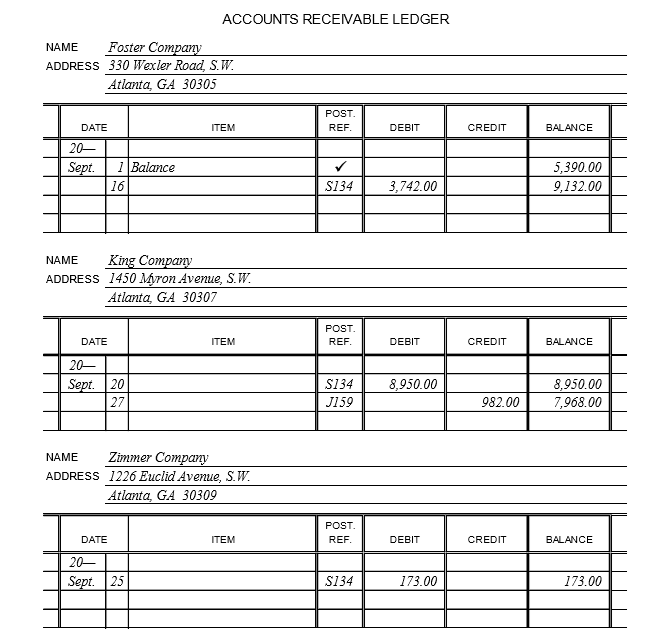

On the balance sheet, it is recorded as accounts receivable signifying that the amount is owed to the company. A lot of retailers use the credit sales option to purchase goods from manufacturers, generate cash when they sell the merchandise, and then pay off the manufacturers from the sale proceeds. When goods are sold on credit, businesses need to record a sales journal entry to correctly reflect the revenue that has been earned. The sales credit journal entry should include the date of the sale, the customer’s name, the amount of the sale and the Accounts Receivable amount. Once the customer pays their invoice, the business will then need to record a separate payment journal entry.

Credit Card Sales Received Immediately

The increased flexibility of credit sales can also be advantageous for businesses. Customers may be more likely to purchase when they can pay over a period of time, rather than having to make a one-time payment. Additionally, some customers may be more comfortable with credit sales, as they provide a way for customers to track and manage their purchases more closely. In a double-entry bookkeeping system, a sales credit journal entry is used to record the decrease in inventory that results from a sale. The journal entry would be debited for the Accounts Receivable and credited for the inventory.

By following this process, companies can keep track of their sales and ensure that they are receiving payments in a timely manner. The credit sales journal entry is important because it aids businesses in ensuring that all sales for either goods or services that were made on credit are properly recorded in their financial records. Sales credit journal entry is vital for companies that sell their goods on credit.

- It is important to note that the company is not yet entitled to cash from the customer, but is instead extending the terms of payment.

- For correct financial reporting and to keep the books of the firm open, these transactions must be properly recorded.

- On the income statement, it is recorded under revenue along with cash sales as sales.

- This type of journal entry is used to keep track of sales that have not been paid for in cash.

- Sales credit journal entries are an important part of keeping track of sales and Accounts Receivable.

- He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries.

The sales discount is used to encourage early payment for goods or services received as the discount is often time-bound. If the customer is unable to pay for the good or service within the stipulated time frame, the sales discount becomes forfeited. Companies normally state the condition under which the customer gets a sales discount in the header section of the purchase invoice.

My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

When a piece of merchandise or inventory is sold on credit, two business transactions need to be record. First, the accounts receivable account must increase by the amount of the sale and the revenue account must increase by the same amount. This entry records the amount of money the customer owes the company as well as the revenue from the sale. The journal entry of a credit sale will result in an increase in both the accounts receivable and the sales account.

It is an asset that is expected to be converted into cash within a relatively short period of time, usually no longer than a year. Advance payments provide the seller with the assurance of payment, but they must wait for the customer to receive the goods/services before they can be paid. Cash sales typically provide the seller with quicker access to their funds, however, the seller must wait until the goods/services are delivered before they can receive payment.

Further, they normally offer a cash discount if the payment is made within a certain period of the actual sale date. In the case of cash sales, the “cash account” is debited, whereas “sales account” is credited with the equal amount. In the case of credit sales, the respective “debtor’s account” is debited, whereas “sales account” is credited with the equal amount. If Michael credit sales journal entry pays the amount owed ($10,000) within 10 days, he would be able to enjoy a 5% discount. Therefore, the amount that Michael would need to pay for his purchases if he paid within 10 days would be $9,500. In a credit sale, the seller usually sets up an account for the buyer and invoices them for the purchase amount, typically including any applicable interest or fees.

Sales transactions can be categorized into three distinct types, each of which has distinct characteristics that differentiate them from one another. On 1 July 2014, Woodworks, Inc. sold 5 office desks, 5 revolving chairs and 10 visitor chairs to A2Z Real Estate Solutions (ARES), for $3,000 with credit terms of 2/10, net 30. CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.