A bank reconciliation is structured to include the information shown in Figure 8.6. The service charge was deducted from the reconciliation because no notification had been received about the amount prior to receiving the statement. An inquiry should also be made concerning the lack of notification about the NSF check.

- Because your bank account gets integrated with your online accounting software, all your bank transactions will get updated automatically and each item will be matched with your books of accounts.

- Interest is automatically deposited into a bank account after a certain period of time.

- Generally speaking, bank reconciliations should be completed on a monthly basis to ensure accuracy and timely updates.

- Note that Community Bank credits its liability account Customers’ Deposits (which includes the individual depositor’s checking account balance).

How much are you saving for retirement each month?

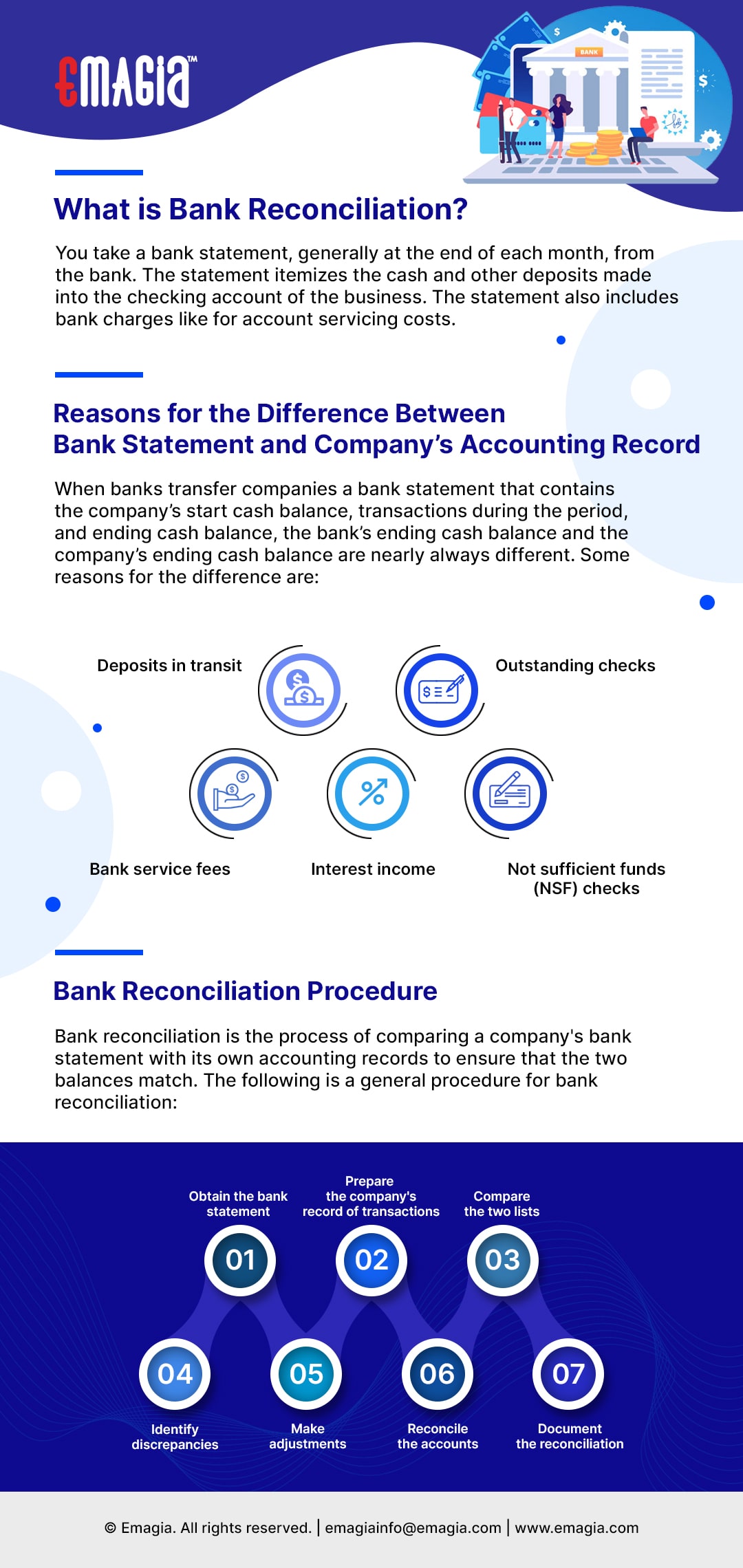

The goal of bank account reconciliation is to ensure your records align with the bank’s records. This is accomplished by scanning the two sets of records and looking for discrepancies. If you find any errors or omissions, journal entry for rent received with example determine what happened to cause the differences and work to fix them in your records. Discrepancies in bank reconciliations can arise from data processing errors or delays and unclear fees at the bank.

Step 4: Account for interest and fees

Another possibility that may be causing problems is that the dates covered by the bank statement have changed, so that some items are included or excluded. This situation should only arise if someone at the company requested the bank to alter the closing date for the company’s bank account. The checks Fender wrote to vendors won’t actually be withdrawn from Fender’s bank account until the vendors actually receive and cash them. The checks Fender received from customers won’t actually appear in Fender’s bank account until they are cashed and the bank clears them. Next, check to see if all of the deposits listed in your records are present on your bank statement.

What Is a Bank Reconciliation Statement, and How Is It Done?

While it cannot entirely erase the potential for data processing errors, using accounting software can reduce the likelihood of errors to help generate more accurate financial statements. By comparing the two statements, Greg sees that there are $11,500 in checks for four orders of lawnmowers purchased near the end of the month. These checks are in transit, so they haven’t yet been deposited into the company’s bank account. He also finds $500 of bank service fees that hadn’t been included in his financial statement. Bank reconciliation is the process of comparing your business’ books of accounts with your bank statements and is done periodically to check whether the bank-related transactions are recorded properly in your books of accounts. For instance, if you use QuickBooks Online, you’ll use the reconcile function to pull up all your bank transactions during a period of time you specify.

During bank reconciliation, you’ll compare the two accounts to ensure they reflect the same transaction details and cash flow amounts. If the accounts don’t match, you’ll need to find the source of the financial discrepancy, repair it, and compare the accounts again to see if they balance. A bank reconciliation statement is a financial document that summarizes your bank account transactions and internally recorded transactions, showing that the two records match. You don’t necessarily have to create a bank reconciliation statement every time you reconcile your accounts—if you perform bank reconciliation every day, you probably shouldn’t. Otherwise, though, statements are a good way to stay on top of your business’s finances.

Bank reconciliation statement

Bank reconciliation statements safeguard against fraud in recording banking transactions. Throughout the course of business, Fender writes checks to vendors for goods and services. These checks are recorded as expenses (cash out) in Fender’s accounting system as soon as the checks are written.

However, the check doesn’t clear until April 9, and $300 is withdrawn from The Tree Company’s bank account and deposited into the cleaner’s account. The final entry is to record the bank service charges that are deducted by the bank but have not been recorded on the records. Generally speaking, bank reconciliations should be completed on a monthly basis to ensure accuracy and timely updates. Typically, each bank account is represented by a separate general ledger account.

With bank reconciliation, you and your stakeholders can make decisions based on your bank records and financial statements, understanding both are accurate. Bank reconciliation means comparing your bank statement’s listed transactions with your business’s internal records, then adjusting your internal accounting records to ensure they’re accurate. It’s also the foundation of small-business accounting and bookkeeping, so you’ll want to familiarize yourself with the process as soon as possible—you’ll be doing it pretty often. A company could record a payment in its ledger, but the payment might not leave their bank account for several days.

As a result, the bank statement balance will be lower than the cash book balance, so the difference will need to be adjusted in your cash book before preparing the bank reconciliation statement. Nowadays, all deposits and withdrawals undertaken by a customer are recorded by both the bank and the customer. The bank records all transactions in a bank statement, also known as passbook, while the customer records all their bank transactions in a cash book. When businesses perform bank reconciliation, they take the time to ensure that every purchase charged to a company’s bank account helps move the business forward.

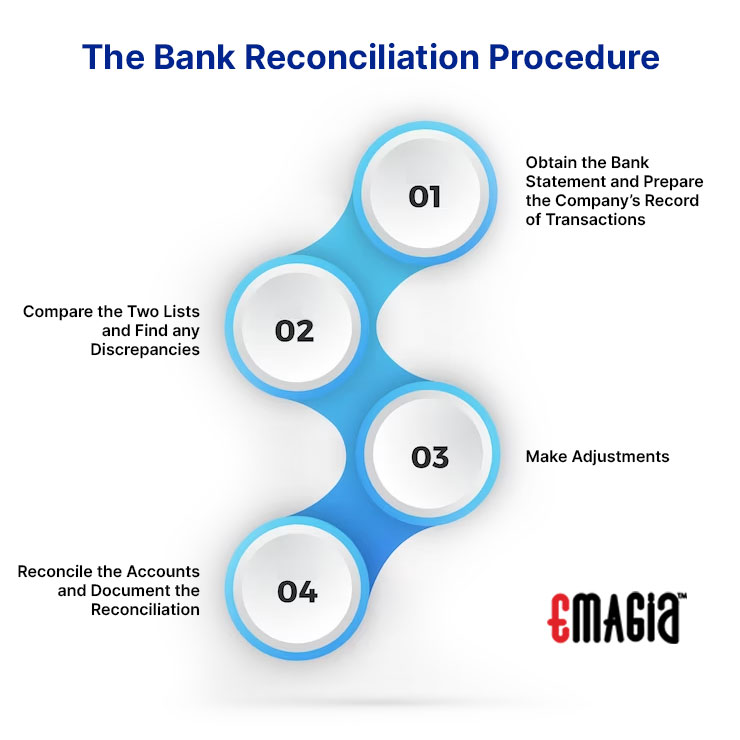

As outlined above, bank reconciliations is a process that compares and matches the financial records of a business with the bank statements to ensure they are consistent and accurate. It verifies that all the transactions and purchases shown in the company’s financial records align with those recorded by the bank for the same period. It also helps businesses adhere to necessary accounting standards while additionally supporting your ongoing cash flow management. This is especially useful for large organizations with complex cash transactions.Finally, bank reconciliation is an essential tool in detecting and preventing fraud. By comparing the transactions included on a bank statement to those recorded in accounting entries, it can be easier to spot any mistakes or suspicious activity within the previous month that may need further investigation.