Sometimes you know the dividend yield immediately, making the task easier. For a refresher, check the how to calculate dividend yield section above. Income investors, or people looking at their investment portfolio as a source of income today, will rely on dividend yield as a starting point when considering which dividend stocks to buy. After all, if you’re living off your portfolio, you have a minimum amount of income you need it to produce. If you’re in this situation, you may prioritize stocks that pay the higher yield today as long as the business is doing well and its earnings and balance sheet are strong enough to keep the payout safe. The opposite of a forward yield is a “Trailing yield,” which shows a company’s actual dividend payments about its market share price of the previous 12 months.

The Difference Between Dividend Yield and Dividend Rate

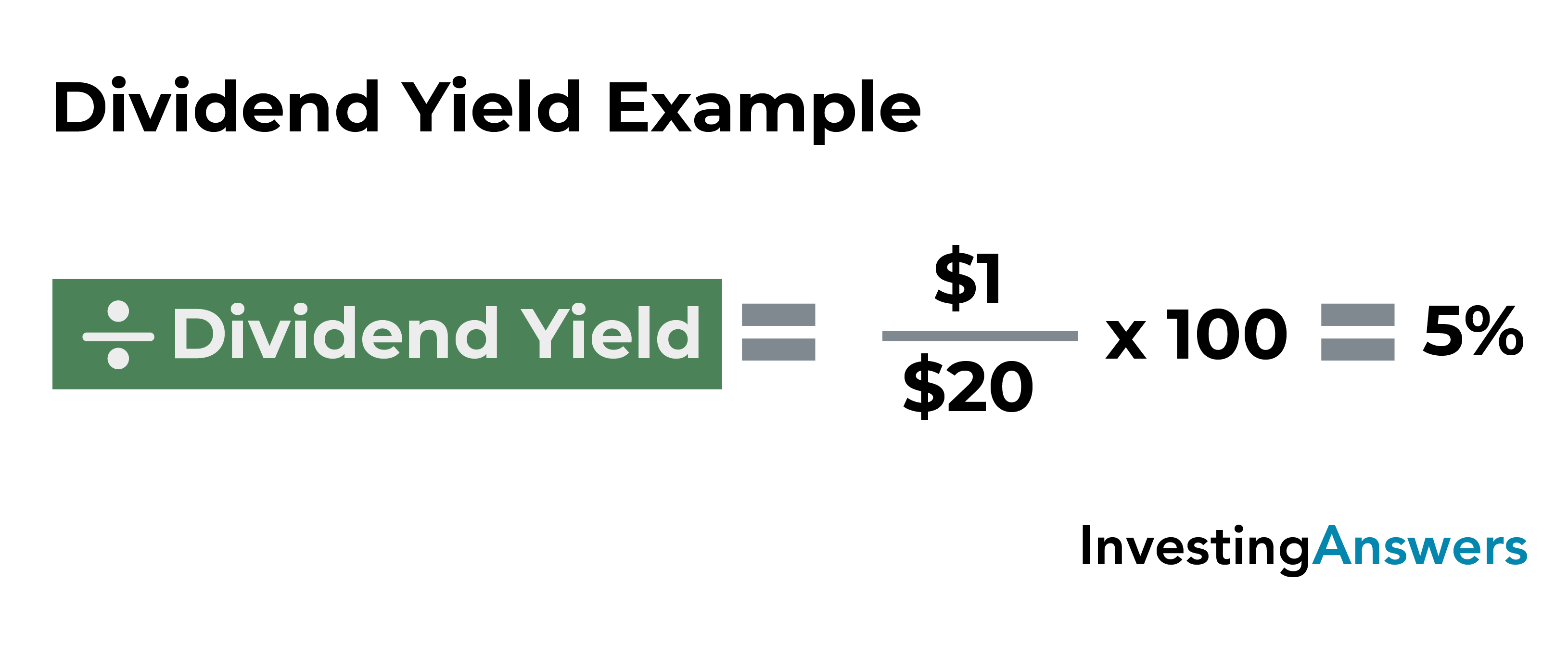

Because of this, dividend yields fluctuate based on current stock prices. Many stock research tools list recent dividend yields for you, but you can also calculate dividend yield yourself. However, the dividend payout ratio represents how much of a company’s net earnings are paid out as dividends. While the dividend yield is the more commonly used term, many believe the dividend payout ratio is a better indicator of a company’s ability to distribute dividends consistently in the future. Company A’s stock is currently being traded at $25 and pays an annual dividend of $1.50 to its shareholders.

The Bankrate promise

Investors can calculate the dividend payout ratio by dividing the total dividends paid in a year by the company’s net income. By looking at this ratio over a period of years, investors can learn to differentiate among the dividend stocks in their portfolios. To calculate a stock’s dividend yield, all you need to do is divide the stock’s annual dividend by its current share price. This value gives you the amount of money the stock’s dividend pays out on every dollar invested in the stock.

- The firm also decides to reinvest the other half to make some capital gains, increasing its value to $5.5 billion ($5billion + $500million) and appeasing its income investors.

- A firm that shows a stock price falling from $50 to $20 is perhaps struggling, and one should make a detailed analysis before considering a plunge in the stocks.

- As a result, firms will never want to adjust their short-term liquidity to woo investors and shareholders.

- Dividends can come in the form of cash payments or shares and are determined by the company’s board of directors.

Are higher dividend yields better?

Dividend yield shows how much a company pays out in dividends relative to its stock price. Dividend yield lets you evaluate which companies pay more in dividends per dollar you invest, and it may also send a signal about the financial health of a company. Dividend yields change daily as the prices of shares that pay dividends rise or fall. A monthly dividend could result in a dividend yield calculation that is too low.

Financial Calendars

The firm also decides to reinvest the other half to make some capital gains, increasing its value to $5.5 billion ($5billion + $500million) and appeasing its income investors. The dividend yield shows the return an investor gets from the dividends paid by a company compared to the current stock price. A higher dividend yield indicates a potentially higher return, but it could also signal risk if the yield is unusually high compared to peers, possibly indicating financial distress or an impending dividend cut.

Forward vs. Trailing Dividend Yield Ratio

However, considering companies are reluctant to cut dividends once implemented, a public announcement that the current dividend payout will be cut is practically always perceived negatively by the market. However, since dividends are paid quarterly, the standard practice is to estimate the annual dividend amount by multiplying the latest quarterly dividend amount per share by four. For example, if a company paid out $5 in dividends per share and its shares currently cost $150, its dividend yield would be 3.33%.

Dividend investing is one of the famous investing strategies that focuses on getting dividends as returns instead of capital gains. Generally speaking, the higher the dividend yield, the better as it means the potential return from dividends is higher relative to the price you pay for the investment. Investors should be aware that, unlike with the interest payments on etf vs mutual fund a bond, dividend payments are not guaranteed. A company can choose to cut or eliminate its dividend whenever it thinks that might be necessary for the health of the company or its shareholders. Hence, there tends to be a drop-off in a company’s share price following news that its dividend is being reduced (or completely cut) – as investors tend to assume the worst.

There is a group of S&P 500 stocks called Dividend Aristocrats, which have increased the dividends they pay for at least 25 consecutive years. Every year the list changes, as companies raise and lower their dividends. SoFi has no control over the content, products or services offered nor the security or privacy of information transmitted to others via their website. We recommend that you review the privacy policy of the site you are entering.